Repealing the Estate tax, a big deal or just more noise?

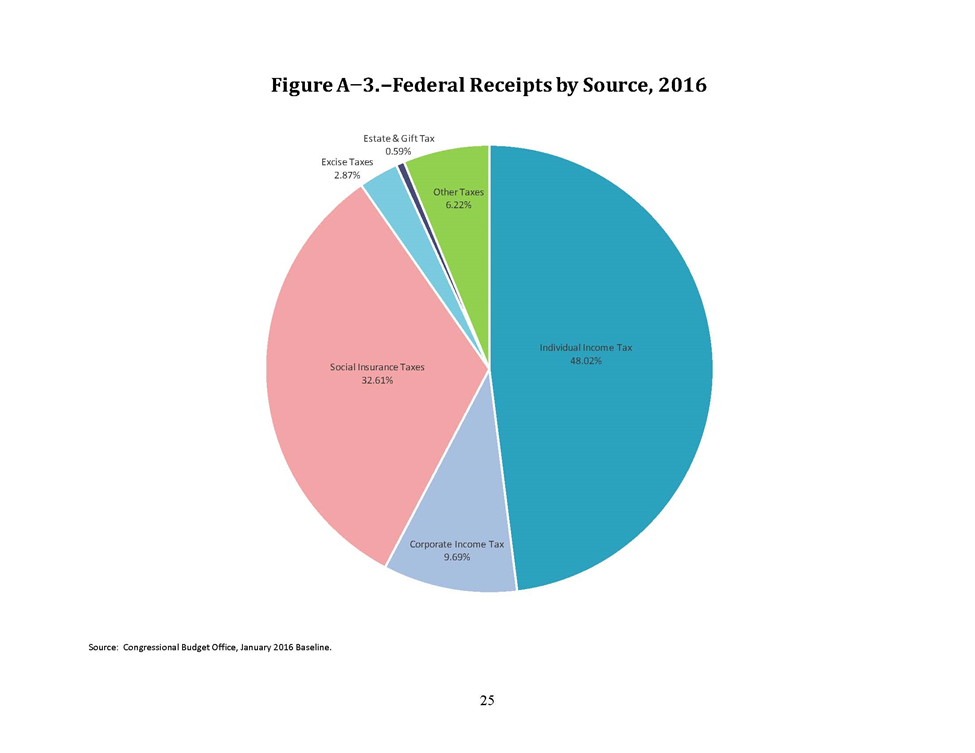

/As previously discussed (here), the Joint Committee on Taxation (JCT) has conducted a study of the source of tax revenues for 2016. As detailed in the JCT study, the Estate and Gift Tax revenues are expected to be 0.59% of the total tax revenue. See Figure A-3, pg. 25 of the JCT report, as follows:

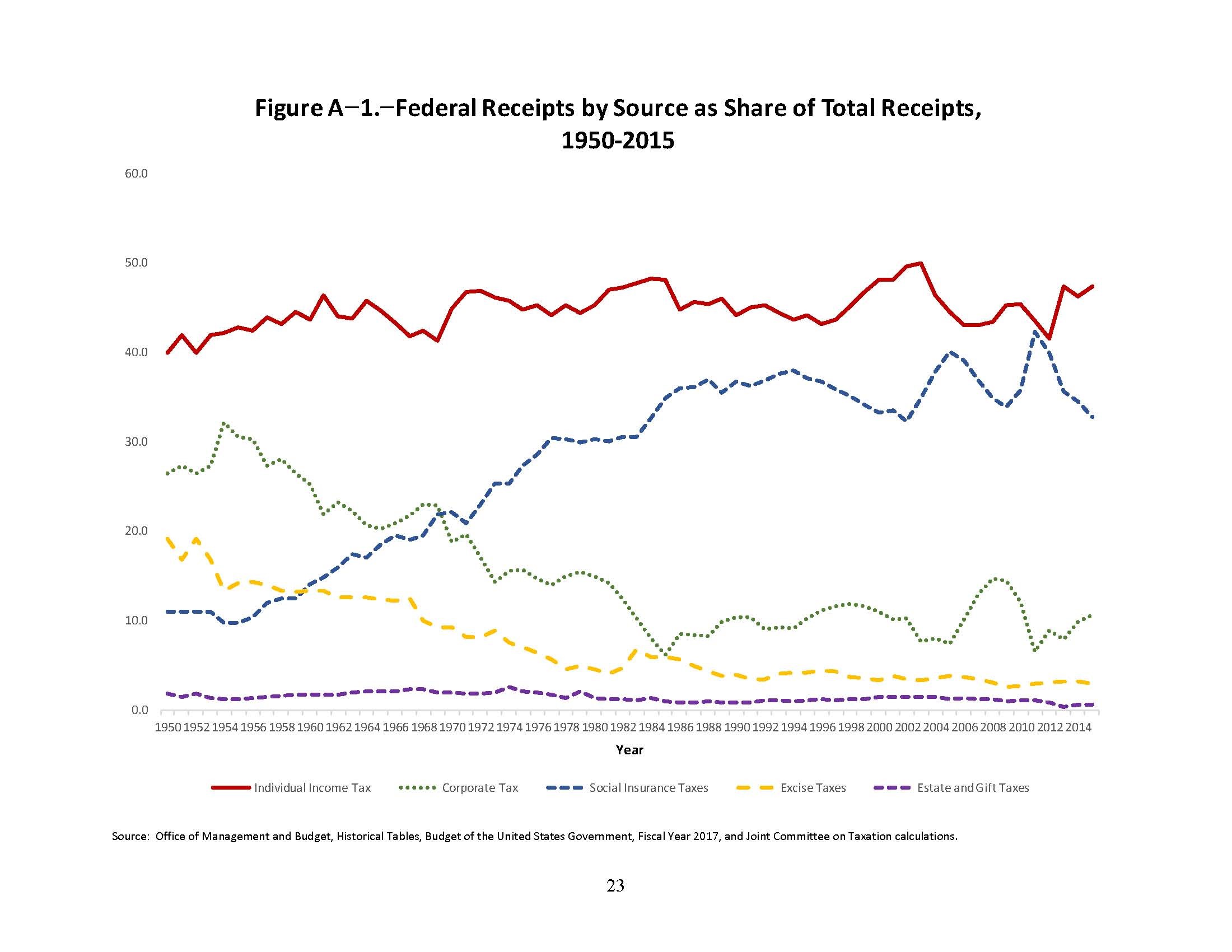

Furthermore, Figure A-1, pg. 23 of the JCT report reflects that since 1950, the revenues from the Estate Tax has generally declined. See Chart below:

What is interesting about these charts (A-1 and A-3, above) is that despite the hullabaloo about repealing the estate tax, see this Washington Post article about the most recent attempts by Republicans in the House voting to repeal the estate tax, the estate tax barely makes a blip in total income received by the IRS and since 1950.

Why does the estate tax represent such a small portion of tax revenue? The simple answer is that the majority of people are exempt from paying estate and gift taxes. Most people are exempt from estate and gift taxes because the law allows most people to five away either: 1) during their life up to $1,000,000 or 2) at death (as of 2016) is $5,400,000. Also, annual gifts do not impact the lifetime gift exemption or at death exemption. The annual gift exemption (as of 2016) is $14,000. Also if you are married, (with tax planning) you can double the amount of gifts that are exempt from the gift and estate taxes. Additionally, if you are married, you can transfer your wealth to your spouse (with tax planning) tax free at your death.

So then why is repealing the estate and gift tax so important to Congress? Simply put, it is an election year and the Congress men and women need their wealthy donors to know that they are watching out for them. That's the argument of the Washington Post article. See also the Tax Policy Center's estimate that only about 2 out of 1000 people who die are affected by the estate tax.

See Forbes for arguments in favor and against the estate tax and/or its repeal. See also USA Today arguing that the claims for harming small business and forcing the rich to sell assets are unfounded, or this USA Today article claiming that the estate and gift tax "punishes success".

If you know an individual who is liable for estate and gift taxes and have specific and credible evidence of their estate tax or gift tax liabilities, contact our office to help you evaluate your information and whether you can claim a tax award from the IRS. The IRS pays between 15-30% of taxes, penalties and interest collected for unpaid estate tax liabilities.